As a family law attorney, many often ask me, “How much does a living trust cost?” They typically ask this because after a divorce, critical changes need to be made to a trust created between spouses as the characterization of the assets in the trust may have changed. Other provisions may not be legally effective anymore contained in the trust. While not specifically limited to those who have just gone through a divorce, living trusts are still excellent for the layperson with assets that must be distributed to loved ones upon their passing.

The Cost of Not Having a Trust

In most cases, not having a trust can actually cost more money to resolve the estate after a passing. This is because probate court will need to administer the division of assets for a deceased person if there is an absence of a trust. Probate court costs can easily exceed $50,000. It will also take longer for the estate to be settled due to court proceedings. This can sometimes take up to two years or more, depending on the estate size.

Financial Burden of Not Having a Trust

An excessive financial burden is taken from the proceeds of a deceased person’s estate to distribute it in probate court.

Costs for probate court can include the following:

- Filing fees

- Court fees Miscellaneous administrative fees

- Hiring an attorney (if required to assist with the action in Court)

- Fees can also be paid to the executor or personal representative of an estate designated to administer the division of the estate

The Burden of Time and Energy on Your Family

Passing without a legal trust can impose a severe burden on your family. It will likely be their responsibility to distribute assets to beneficiaries. This can take their personal time and energy and can be stressful in many situations. For example, family members are often tasked with locating and finding people to benefit from the estate. They must also ensure that distributions to beneficiaries are done correctly and lawfully if your intent was established in a legal will. An executor of an estate (often a family member) will have to attend court and appear to update the court regarding the estate distribution.

How Long Does a Living Trust Take to Complete?

Completing living trust documents will depend on how complex you want your division of assets to be. It will also depend on the size of the estate. For example, having multiple real estate properties may take longer to prepare. This is because legal deeds are connected to transferring the properties to the trust. In most cases, an attorney in the field can prepare the legal trust documents in a few weeks. This is contingent on you submitting the necessary information and documents to prepare the trust. This should include a detailed list of all assets that can be transferred into the trust.

What is Usually Included in the Fee?

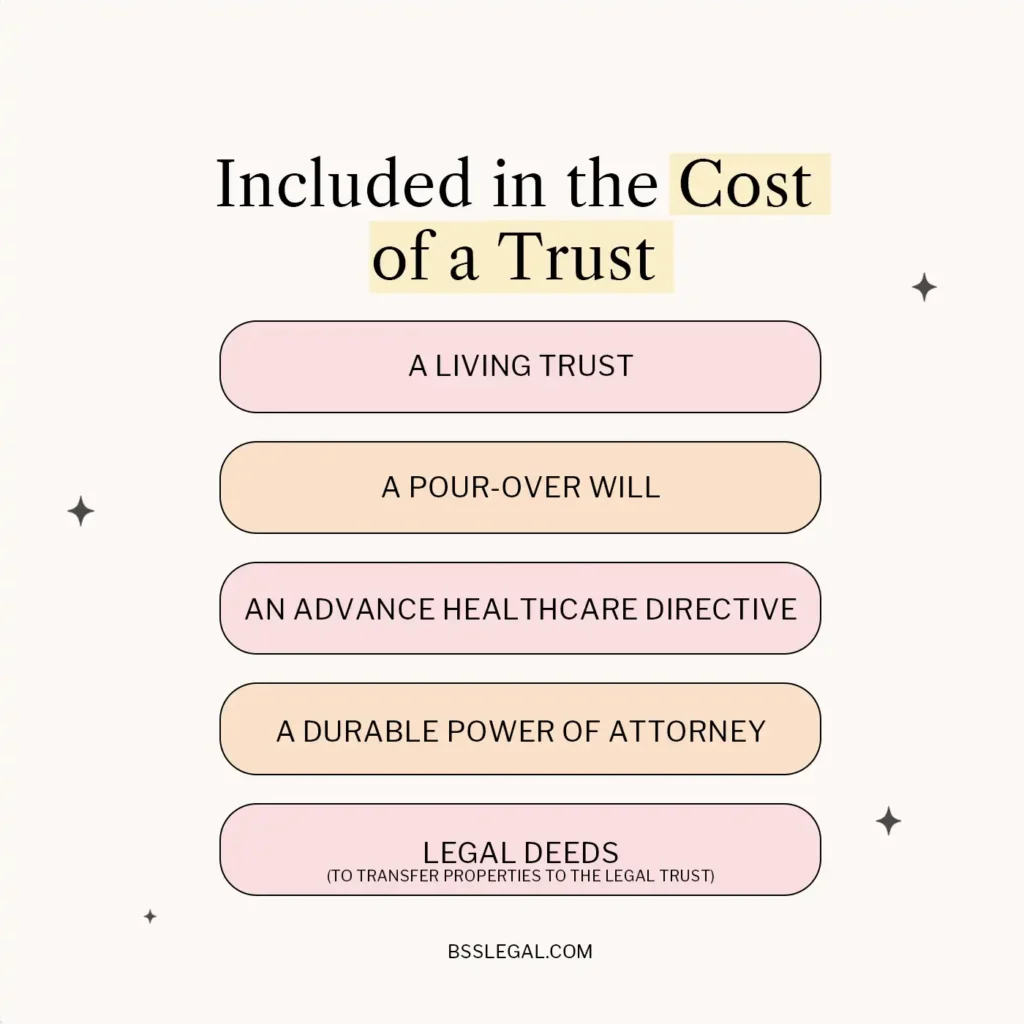

A comprehensive estate plan consists of a collection of documents prepared to provide protection for many events related to death, incapacitation, or end-of-life care.

This will include:

- A living trust

- A pour-over will

- An advance healthcare directive

- A durable power of attorney for finances

- Legal deeds to transfer properties to the legal trust

Advance healthcare directives and durable power of attorney for finances serve as a tool to name somebody you trust to administer healthcare and financial decisions on your behalf in a situation where you may not be deceased but incognizant (e.g., a coma).

Will it Require Updating?

Yes, updating your trust over time is required in many instances. It does not have to be very frequent, but if a circumstance changes that affects the terms of how the trust is drafted, then it will require an amendment or restatement. For example, somebody you named to distribute the trust upon your passing might have passed before you. There might have been a falling out with that person, and you want to write them out of the trust. If there is an acquisition of a new property or a sale of one, it should be reflected in a trust amendment as well.

Financial Cost of a Living Trust with Burgos Santoyo Smith, Inc.

The cost to draft a living trust at Burgos Santoyo Smith, Inc. starts at $2500.00. Depending on the additional documents needed or the complexity of your estate, additional costs may apply. If you would like to add an advance healthcare directive, durable power of attorney for finances, and pour-over will then there will be additional charges. Transferring specific assets to the trust, such as real estate, can also entail a fee per transfer. If there is a trust update, such as an amendment or restatement, the cost is mainly reduced, but this can also depend on the size of the estate.

Please contact Burgos Santoyo Smith Legal today to schedule a consultation. We are here for your estate planning matters if you require any legal assistance.